General investment account tax calculator

You can start a GIA with as little. The calculator will then increase the contribution amount for the tax-deferred investment by the amount required to make the net contribution equal to the investments that have contributions.

What Is Annual Income How To Calculate Your Salary Income Financial Health Income Tax Return

In the UK there are three main investment accounts are.

. General Investment Accounts GIAs are a simple way to invest and a great option. Use our Capital Gains Tax calculator to work out what tax you owe on your investment profits. The 38 Net Investment Income NII federal tax applies to individuals estates and trusts with modified adjusted gross income MAGI above applicable threshold.

Capital Gains Tax is basically a tax that youre charged on money you make from selling an. Start Crafting Money-Saving Tax Strategies for Clients with Our 2023 Projected Tax Rates. Barbara Friedberg is an author teacher and expert in personal finance specifically investing.

Using the figures outlined above you add 18900 in gains to 19000 in taxable income to give you a total figure of 37900. For nearly two decades she worked as an investment portfolio. This calculator shows an illustration of what your investments could be worth and not a projection of what your investments will be worth.

Ad Were all about helping you get more from your money. Capital gains taxes on most assets held for less than a year correspond to. Ad Get Your Copy of Bloomberg Taxs 2023 Projected US Tax Rates Special Report.

If youve used your ISA allowance for the current tax year and have more to invest then this could be the account for you. Ad Calculate and Compare a Normal Taxable Investment to Two Common Tax Advantaged Situations. Definitions Compare Investments and Savings Accounts INVESTMENTS Best Safe Investments Best Brokerage Acct Bonuses.

The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. You can invest as much as you like. Trade stocks bonds options ETFs and mutual funds all in one easy-to-manage account.

The tax rate on capital gains for most assets held for more than one year is 0 15 or 20. With our general investment account you can invest in our managed efficient portfolios tailored around your goals and investor profile. Free Calculator to Help Compare Taxable Investment to 2 Common Tax Advantaged Situations.

And is based on the tax brackets of 2021. 1 The UK tax year runs from 6 April to 5 April each year. Ad Smart Investing Can Reduce the Impact of Taxes On Investments.

This investment growth calculator is intended to help compare a fully taxable investment to two tax advantaged situations. Refer to the basic rate tax band The basic rate. Start Crafting Money-Saving Tax Strategies for Clients with Our 2023 Projected Tax Rates.

Investment Tax Calculator Tools Investment Tax Calculator Eaton Vance Parametric Investment Tax Calculator Making smart investment decisions requires understanding the. Find out using Bankrates investment calculator below. You can top up your GIA at any time.

GIA general investment account Stocks and shares ISA individual savings. This means that up to 5000 of the interest received from savings is tax-free. Or as much as you like.

If youve used up your annual ISA allowance. You can earn up to 17570 a year in 2022-23 as long as your personal allowance is the standard. Our general investment account is an easy flexible way of investing more of your money in the markets on top of your 20000 ISA allowance.

2 The personal savings allowance for the 202122 tax year is 1000 for most basic rate taxpayers 500 for higher-rate. Lets get started today. It is mainly intended for residents of the US.

What is a General Account. Well do the hard work choosing and building. If youre currently making regular monthly contributions you can add as much as youd like.

In one situation an investment account is not taxed until the. Contact a Fidelity Advisor. The minimum investment amount is 100.

Ad Get Your Copy of Bloomberg Taxs 2023 Projected US Tax Rates Special Report. The calculator offers three alternative.

2021 2022 Income Tax Calculator Canada Wowa Ca

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Calculating The Gross Margin Ratio For A Business For Dummies Gross Margin Income Statement Profit And Loss Statement

Effective Tax Rate Formula And Calculation Example

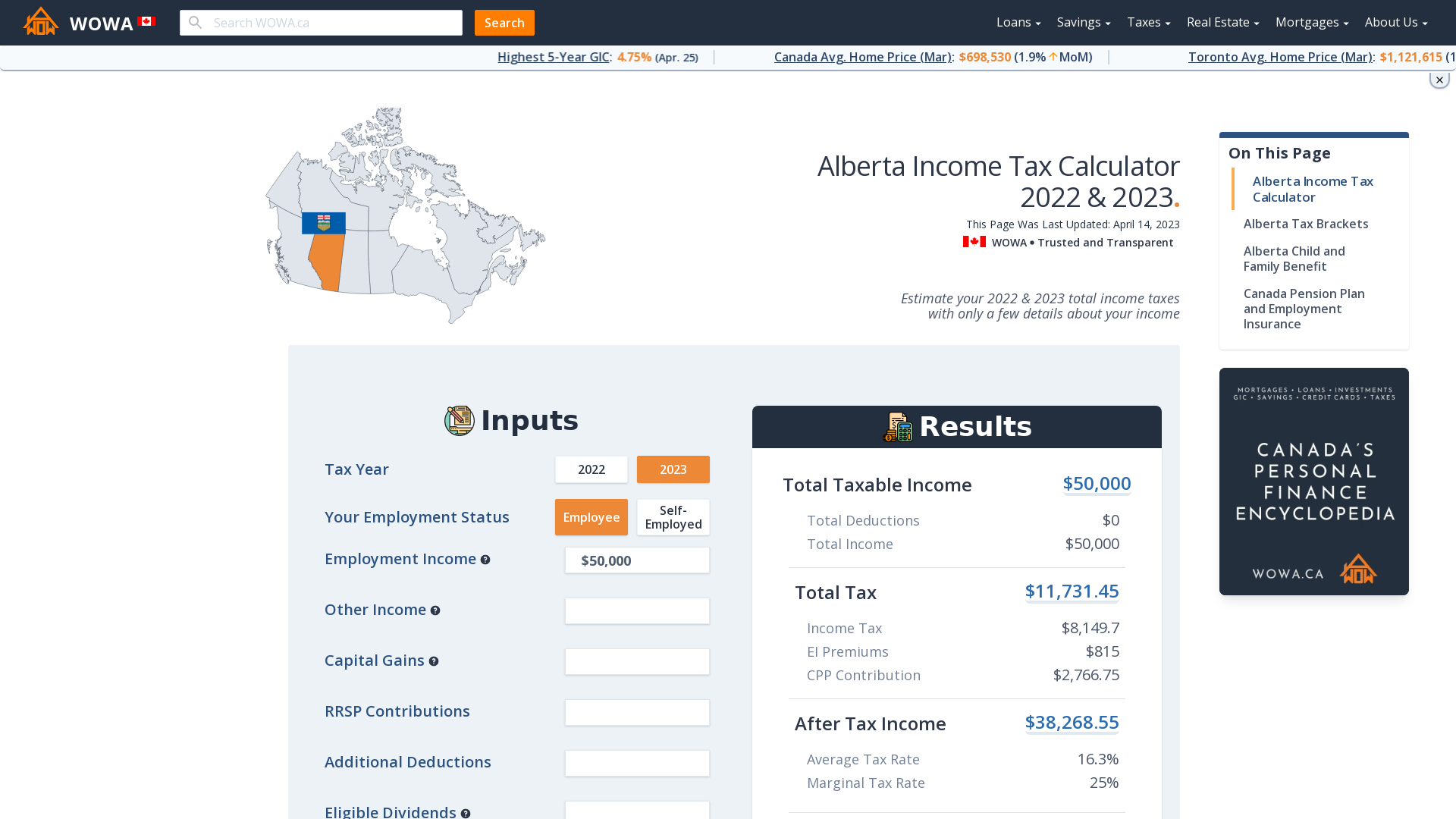

Alberta Income Tax Calculator Wowa Ca

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

Current Ratio Calculator Financial Strategies Accounting Basics Budgeting Money

Tax Calculator Estimate Your Income Tax For 2022 Free

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Marginal Tax Rates How To Calculate Ontario Income Tax Kalfa Law

Canada Capital Gains Tax Calculator 2022

Income Tax Prep Checklist Free Printable Checklist Tax Prep Checklist Tax Prep Tax Checklist

1031 Exchange How Do Sales Costs Of Dst S Compare With Traditi Investing Corporate Bonds Selling Real Estate

Investment Property Analyzer Rental Property Calculator Etsy Rental Property Rental Property Investment Investment Property

Tax Free Savings Account Tfsa My Road To Wealth And Freedom Tax Free Savings Savings Account Small Business Tax Deductions

Net Profit Margin Calculator Bdc Ca

Pin On Financial Ideas